Empower Your Financial Trip: Why Professional Credit Report Counseling Is Essential

Expert credit rating counseling serves as a valuable source in this journey towards economic security and success. The advantages of professional credit score therapy prolong far past just immediate financial alleviation.

The Influence of Credit Score Counseling

Via tailored economic assistance and organized debt management strategies, professional credit score counseling significantly improves people' monetary health and creditworthiness - credit counselling services - EDUdebt. By educating individuals on exactly how credit report jobs and how to utilize it properly, credit counselors assist clients develop healthy monetary behaviors that can favorably influence their creditworthiness over time.

In addition, credit report therapy can assist people in creating effective budgeting skills and creating workable settlement prepare for their debts. This not only lowers economic stress but also helps people function in the direction of coming to be debt-free. In addition, credit report counseling can provide valuable insights right into credit score report mistakes or errors, making it possible for customers to fix these concerns and boost their credit rating profiles. Overall, the impact of professional credit rating counseling is profound, equipping individuals to attain better monetary security and success.

Financial Education and Awareness

Among the foundational columns of professional debt therapy is the emphasis on economic education and awareness. Understanding individual finance ideas such as budgeting, conserving, investing, and handling debt is critical for individuals to make enlightened choices about their monetary health. Through expert debt counseling, people can gain the understanding and abilities necessary to browse the intricacies of the financial world and accomplish their long-term financial objectives.

Economic education and learning equips people to take control of their finances, make sound economic choices, and plan for the future. It furnishes them with the devices to create efficient budgeting approaches, build cost savings, and take care of financial obligation sensibly. By raising financial literacy and recognition, expert credit rating counseling assists people establish a much deeper understanding of economic product or services, allowing them to make enlightened selections that align with their financial objectives.

In addition, financial education plays a vital role in promoting economic security and safety and security. credit counselling services - EDUdebt. By fostering a culture of financial understanding, expert credit therapy aids people stay clear of typical financial pitfalls, protect themselves from fraud, and strategy for unanticipated expenditures. Inevitably, purchasing economic education and learning via expert credit rating counseling can lead to boosted economic well-being and a much more secure monetary future

Financial Debt Administration Strategies

Comprehending the significance of monetary education and learning and awareness lays the foundation for applying efficient financial obligation my latest blog post monitoring strategies in professional debt counseling. One crucial approach frequently employed in credit score counseling is creating a structured payment strategy customized to the person's financial situation.

Along with repayment strategies, credit scores counselors likewise concentrate on enlightening people concerning budgeting, conserving, and liable spending habits to avoid future financial debt issues. By establishing a strong monetary foundation and cultivating healthy monetary practices, individuals can not only tackle their current debts but also prevent falling back right into financial obligation in the future.

Additionally, financial obligation administration methods in expert credit score therapy typically include offering emotional support and encouragement to individuals battling with debt-related stress. This holistic method addresses both the emotional and useful aspects of financial debt monitoring, moved here equipping individuals to take control of their economic wellness.

Credit Rating Improvement Techniques

When intending to enhance one's credit report score, applying critical monetary methods is crucial in achieving lasting financial stability and integrity. One reliable strategy to enhance a credit history rating is to make sure prompt repayments on all debt accounts.

On a regular basis evaluating credit scores records for errors and disputing any kind of inaccuracies is additionally vital for credit scores rating enhancement. In addition, limiting the number of brand-new credit scores applications can stop unnecessary debt queries that might adversely impact the credit scores rating.

Long-Term Financial Preparation

Expert credit rating counselors can supply expertise in budgeting, financial debt monitoring, and cost savings approaches to aid individuals navigate complicated financial decisions and stay on track towards their long-term objectives. By integrating specialist credit scores counseling into their financial planning efforts, individuals can acquire the understanding and tools essential to safeguard a secure economic future.

Conclusion

In final thought, professional credit history counseling plays a crucial duty in equipping individuals on their monetary journey. By offering beneficial understandings, education, and strategies, credit scores counseling can aid people manage their debt, boost their credit rating ratings, and prepare for long-term economic stability. Making the most of expert credit history therapy solutions can cause significant renovations in financial wellness and general monetary health.

Furthermore, restricting the number of brand-new credit report applications can avoid unnecessary credit rating questions that may negatively impact the credit score.Enhancing one's debt score through tactical financial practices like timely repayments and debt utilization management lays a structure for reliable lasting economic preparation. By giving beneficial understandings, education and learning, and methods, credit score therapy can aid people manage their debt, boost their credit score ratings, and strategy for long-lasting financial security.

Scott Baio Then & Now!

Scott Baio Then & Now! Angus T. Jones Then & Now!

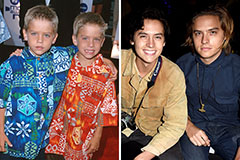

Angus T. Jones Then & Now! Dylan and Cole Sprouse Then & Now!

Dylan and Cole Sprouse Then & Now! Jonathan Lipnicki Then & Now!

Jonathan Lipnicki Then & Now! Destiny’s Child Then & Now!

Destiny’s Child Then & Now!